In 2019 your favourite (or not) fast-food chain McDonald’s reported a whopping $ 21 billion revenue. The order of magnitude is definitely not surprising for a company that’s literally omnipresent, but a further breakdown of its reported revenue and income will make you see that McDonald’s does more than just flipping burgers.

McDonald’s might be selling over a 100 billion burgers each year, but food sales form a small component of its overall revenue.

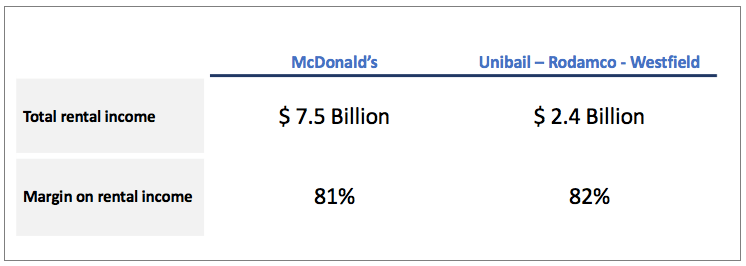

You see, on the face of it McDonald’s is a fast food chain. But over $ 7.5 billion or 36% of its total revenue comes from leasing out real estate to franchises. A further 20% can be attributed to royalties. This not-so-insignificant rental component of McDonald’s overall revenue makes it comparable to commercial real estate companies such as Unibail – Rodamco – Westfield.

Let me explain.

McDonald’s has two broad sources of revenues: sales by company-owned restaurants and fees from franchised restaurants. Fees from franchised restaurants include both rent and royalty, based on a percent of sales and minimum rent payments. In a nutshell, franchised restaurants are operated by individuals contracted by McDonald’s. The franchisee is responsible for all undertaking all costs associated with running a restaurant and for making rent and royalty payments to McDonald’s.

What is McDonald’s role in the arrangement?

It owns, and subsequently rents out, prime real estate.

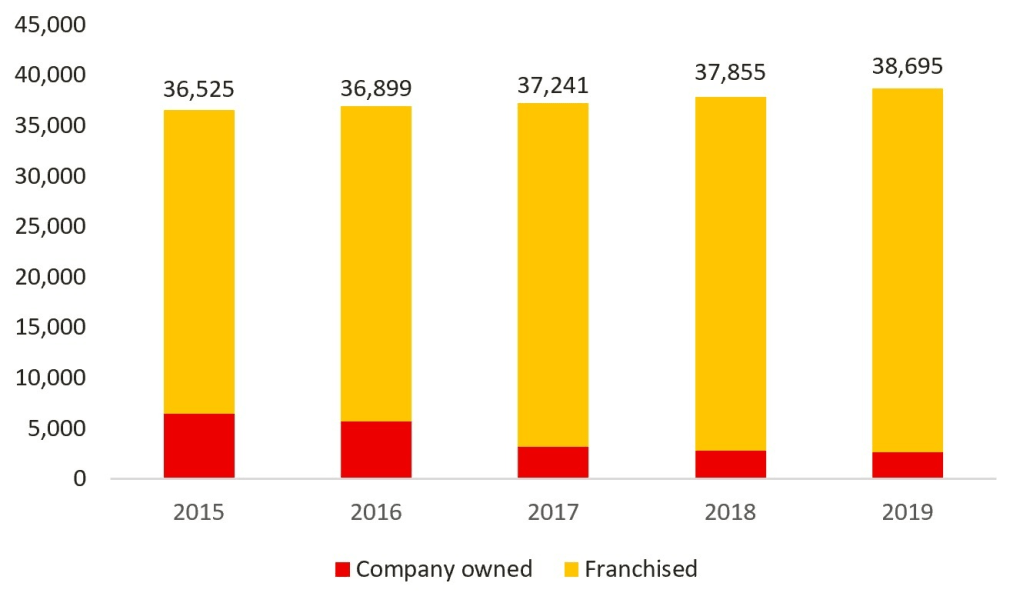

As of 2019, there are 38,700 McDonald’s restaurants around the world. Of these, over 36,000 (93%) are franchised. In fact, over the last few years, McDonald’s has been opening more and more franchised restaurants at the cost of company-owned restaurants. Why? Because franchisees are more profitable. Let’s see why.

Unsurprisingly, McDonald’s has to pay a hefty bill to maintain and operate the restaurants it owns. Costs associated with running a restaurant can quickly pile up – and being able to get rid of these costs is a primary driver of success – and profits – for McDonald’s.

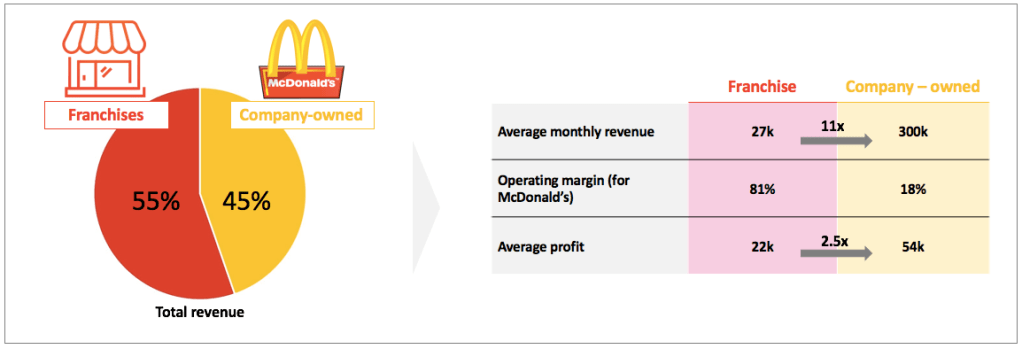

The average monthly revenue of a company-owned restaurants is 11 times the revenue McDonald’s gets from a typical franchise. However, the corresponding difference in profits is only 2.5x [This is because a company owned store has an operating margin of 18%, whereas a franchise has an operating margin of 81%].

In several instances, McDonald’s doesn’t even own the land/ property it rents out to franchises: close to 50% of its rental income is derived from sites that are sub-leased to franchises at jacked up prices:

The Company is the lessee in a significant real estate portfolio, primarily through ground leases (the Company leases the land and generally

owns the building) and through improved leases (the Company leases the land and buildings).We generally own or secure a longterm lease on the land and building for conventional franchised and Company-operated restaurant sites. We seek to identify and develop restaurant locations that offer convenience to customers and long-term sales and profit potential.

McDonald’s Annual Report, 2019

Bottom line is…

What looks like a fast food chain on the face of it has primarily become a real estate company: McDonald’s makes money not by selling food, but by leveraging it’s product and brand to franchisees who HAVE TO lease properties, often at large mark-ups, that are owned by McDonald’s.

Owning all this prime real estate around the world – Old Donald’s got to be lovin’ it.