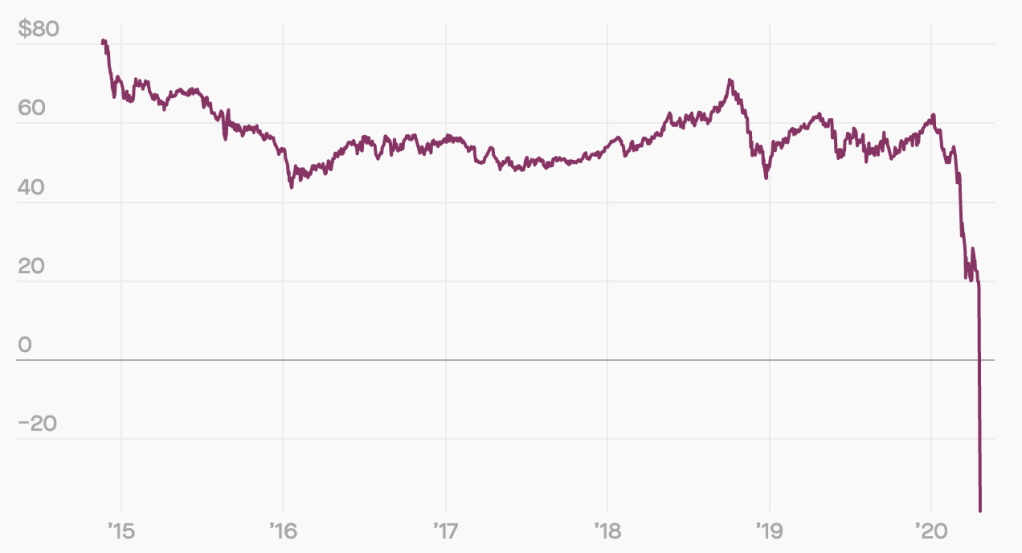

We woke up to a shocker today – the COVID-19 crisis has led to negative oil prices for the 1st time in history. Yes, that is right, producers are paying buyers to buy their oil. Here’s a quick primer on what’s going on for people who are new to the oil world.

Crude oil is the naturally occuring form of oil, composed primarily of hydrocarbons. It is refined to produce various products we use in everyday life such as gasoline and diesel. While the world is actively trying to switch to renewable energy, crude oil is still the primary source of energy (accounting for ~35% of our energy needs in 2018). Based on geographical location and extraction method, crude oil is of two types:

Brent Crude: Brent crude is the most ubiquitous oil that is used for two thirds of all oil pricing. It is produced near the sea, making it easier (ergo cheaper) to transport. The production is primarily dominated by OPEC (Organization of Petroleum Exporting Countries).

West Texas Intermediate (WTI): WTI is the crude oil with lowest density and sulphur content, making it the light-sweet crude oil. As the name suggests, it is extracted primarily in Texas and refined in the Midwest and Gulf of Mexico. The low sulphur content means it is easier to refine, making it ideal for gasoline, also known as petroleum.

While the superior quality would logically imply that WTI be costlier than Brent, that is not always the case. The two have their own demand-supply curves. WTI prices have in general fallen since the shale boom in the US i.e. technology advancement that made extracting oil trapped inside rock structures economically feasible.

So why have oil prices been falling? Is COVID-19 the only culprit? Most certainly not.

2020 has been an extremely volatile year for oil. At the onset of the COVID-19 crisis, Saudi Arabia proposed that OPEC & Russia (two major oil producers) cut down production to stabilize oil prices. Russia however decided not to play along, causing Saudi Arabia to retaliate. This led to a 30% drop in oil prices on March 9th (the largest one day drop since the 1980s).

Now, with too much excess supply and the world under lockdown, crude oil demand is at record lows. Piling inventories are racking up storage costs for producers, who are slashing prices only to move oil from their inventory to their client’s. This price cut, exaggerated by the hyper-active commodity futures & ETF markets, led to the price of WTI crude falling below zero.

What is the tangible implication of sub-zero oil prices? Does an oil producer pay its client to take its oil?

Yes and no. Yes, a negative oil price would mean a buyer gets paid to take oil. However, it is oil they don’t need meaning that it will stack up in their inventories until the beginning of the post COVID-19 era. Therefore, buyers cannot capitalize on this opportunity because the cost to transport and store the oil would wipe off any cash (and more) that buying the oil brings in.

Short term demand-induced price drops in general do not help buyers. The price is dropping simply because the buyer cannot put the oil to a use that yields more profit than the cost of the oil. Once the said economic opportunities arise (post COVID-19 in this case), the demand would go up and so would prices.

All said and done, the sad news is that we are most definitely not getting paid to fill up our car tanks. So what next?

All prices will bounce back once the world reopens, however the worst is most likely yet to come.

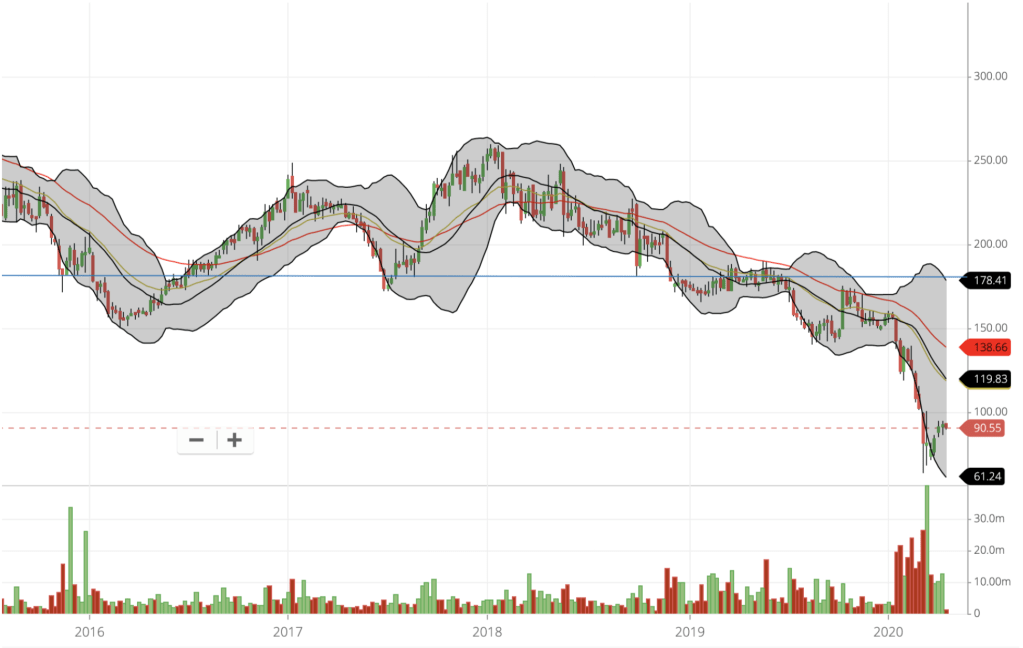

As a retail investor, this would be a good time to invest in oil ETFs / stocks of major oil producers for the short to medium term. Given the high volatility of all markets today, investing in futures is no better than the russian roulette. However, with oil prices where they are today, equity investments in medium term are likely to yield good results.

From a purely technical perspective, I would expect the Oil India Ltd. (NSE: OIL) to take its next support at Rs. 175 (currently trading at Rs. 90.55). Based on how fast economic activity takes up, it could soar higher too.