There is no denying that technology is taking the world by storm. Instead of just being a support function, technology has become the product itself – especially in finance.

The evolution of FinTech is creating new challenges for banks to overcome and new business models are emerging. Neo banks and Challenger banks are cases in point. Let us explore what they are and why incumbents should be wary:

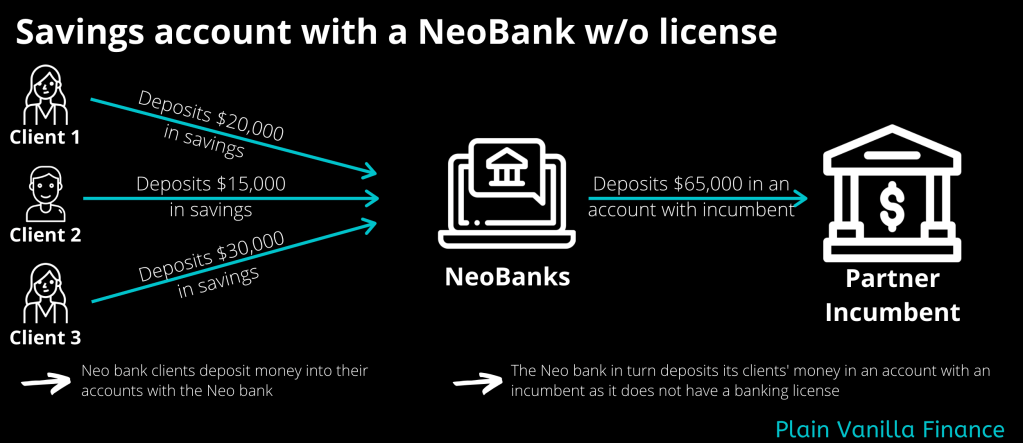

Neo banks are fully digital banks that have no physical presence. They connect with customers via mobile apps and web platforms. Depending on what license (or lack thereof) they possess, Neo banks provide a range of services – traditional banking services such as current account, savings account, different loans, money transfers and tech-enabled services such as API linking, analytics, mobile apps. Neo banks may also partner with an incumbent to make up for lack of license as shown in figure 1.

By going digital-only, Neobanks avoid the cost of leasing/renting and maintaining premium real estate that form a significant portion of a traditional bank’s operating costs. Further, their technology is far superior to that of incumbents, allowing for a faster, smoother and more tailored user-experience. This agility is especially beneficial for SMEs that can integrate their bank into their value chain further reducing administrative costs. Retail customers benefit from lower fees, higher returns on savings and a better overall experience – provided they are willing to entrust their money to an organization they have never met.

For some, this is too big a compromise – that is where challenger banks come into play. A challenger bank has a full banking license, thus can provide all services that an incumbent offers, and more. They generally have physical locations too (though not as many as the incumbents), which builds trust and familiarity in the general population. Challenger banks have significantly better digital platforms managed at significantly lower costs compared to incumbents. Thus, challenger banks are better able to meet the needs of retail clients who need to visit the bank to be able to trust them.

Is it a bed of roses ahead for the tech-enabled banks? Of course not.

The incumbents still have scale and familiarity on their side. While the new banks are extremely successful raising deposits, lending is a whole different story especially with NeoBanks. Zuno is a case in point. The all digital bank had EUR 800mn in deposits, but a loan-to-deposit ratio at a measly 10%. Ultimately, Zuno was unable to achieve profitability and lost EUR 130mn over its life. Thus, the key challenge for fin-tech firms is being able to sell the high fee money making products.

From what we read above, it appears that all the new firms have is great technology that allows them to do a bunch of stuff. Why are then incumbents so left behind in the digitalization race?

Firstly, incumbents are weighed down by legacy IT systems. 70% of the IT budget for incumbents goes into maintaining legacy systems, leaving only 30% for upgrades. Moreover, with years of upgrades, many of them being a ‘Jugaad’, legacy systems are extremely inflexible. Thus, it is cumbersome for incumbents to exceed, or even match, the new players in terms of technology.

Secondly, the scale exposes incumbents to far greater financial and reputational risks relative to new players, making them hesitant to make significant changes in their systems.

Finally, incumbents have significant administrative lethargy built over time. Thus, they find it difficult to match the lower prices and higher interests offered by new players, despite their scale.

While addressing these issues is one solution, another, more adopted solution by incumbents is to launch (or acquire) a separate digital entity to tap into the growing market. The ideal entity sets up an independant IT backend to not be weighed down by the legacy system, but at the same time legerages the parent bank’s client base to achieve the necessary scale for its operations.

That said, there may exist a third player better positioned than the incumbents and challenger/neobanks to dominate the evolving data-driven financial services market – big techies. We shall analyse these competition dynamics in another article.

To conclude, new banks appear to be leading the digitization race but the incumbents still have scale on their side. However, they need to act quickly before the tables turn.