Efficient frontier

Long-Short strategy

No arbitrage prices

Plain Vanilla Bonds

There are 2 things common between these four terms.

First, they have something to do with finance

Second, they seem to be complicated concepts

Jargon is ubiquitous in the world of finance. So much so, that it seems the banks and other financial institutions use them on purpose to confuse clients. As a business school student specializing in finance, decoding jargon while reading textbooks has been the most challenging part for me.Hence, in an effort to stand out from the crowd, that is the jargon speaking people of the financial world, I have started this blog. Here I will talk about interesting financial concepts and events (both current and historic) while explaining the jargon involved as we go along.

It is only fair that the first post breaks down the name of the blog – Plain Vanilla Finance.

Plain Vanilla comes from Plain Vanilla Bonds.

When a company decides to take a loan from the financial markets, they issue bonds. Hence, bonds are nothing but pieces of paper that describe the terms and conditions of the loan. They are classified into different types based on their payment structures, and the simplest payment structure is of the Plain Vanilla Bond.

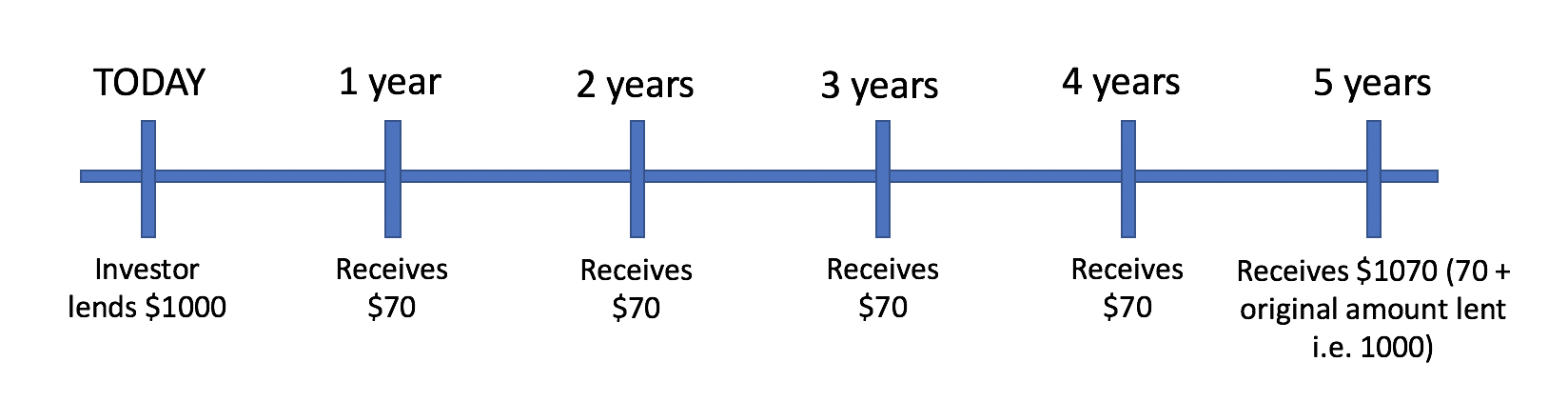

In case of a plain vanilla bond, the investor lends the company some money, say $1000, for a fixed period of time, say 5 years, and receives periodically a fixed interest rate, say 7% annually.

Hence for the plain vanilla bond described above, the investor receives 7% of $1000 i.e. $70 every year for 5 years and finally gets back the original $1000 at the end of the 5th year.

This sums up the most basic, hence the plain vanilla, bond.I invite you to join me in this journey to untangle and explore the beautiful world of finance as I discuss events ranging from tales of rags to riches to complete devastation in times of financial crisis.